Reliance Share Price 2025: Growth, Q1 Results & Future

📊 Reliance Share Price 2025 – बढ़ती कीमत, मज़बूत कमाई, और भविष्य का भरोसा

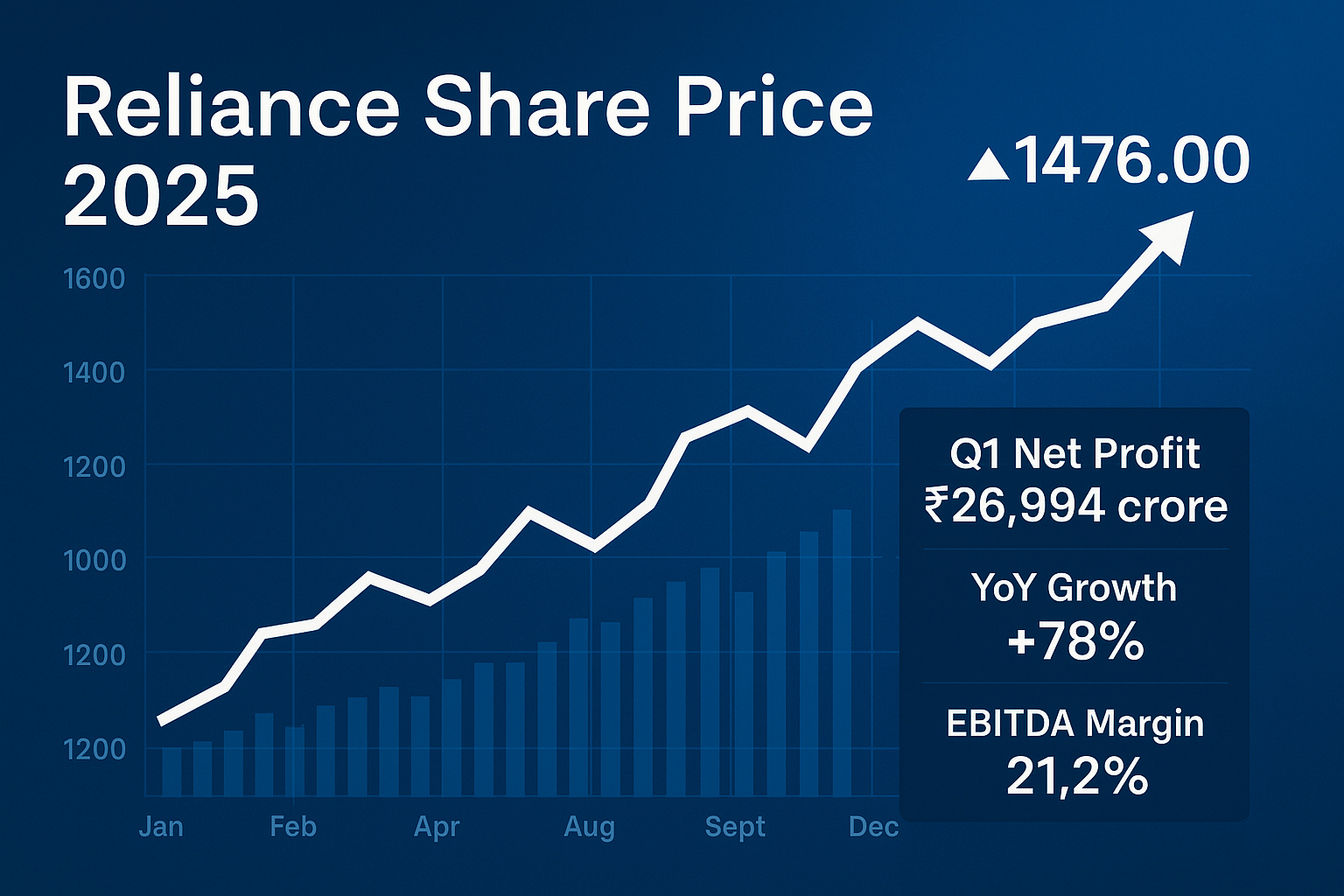

Reliance Industries Limited (RIL) Bharat ki sabse badi private company hai, jo energy, telecom, retail, aur digital services jaise kai sectors mein kaam karti hai. July 2025 tak, Reliance ka share price ₹1476 ke aaspaas trade kar raha hai, jo investors ke liye ek solid point of interest ban gaya hai.

📈 2025 Mein Reliance Ka Performance

Is saal, Reliance ne apne investors ko kaafi khush kiya hai. January 2025 se lekar July tak, share price mein lagbhag 20–22% tak ki growth dekhi gayi hai. Ye tab hai jab broader Nifty50 index sirf 6% ke aaspaas hi upar gaya.

Yeh growth Reliance ke powerful quarterly results, naye investments aur diversification strategy ka result hai. Mukesh Ambani-led group ne har segment – chahe wo Jio, Retail, ya Oil-to-Chemical (O2C) ho – sabhi mein impressive numbers dikhaye hain.

💹 Q1 FY26 Results – Reliance Ka Takatwar Quarter

2025 ke pehle quarter (April–June) ke results Reliance ke liye bahut hi strong rahe:

- Net Profit: ₹26,994 crore (YoY growth ~78%)

- EBITDA: ₹58,024 crore

- EBITDA Margin: 21.2%

- One-time gain: ₹8,924 crore from Asian Paints stake sale

Ye numbers Reliance ki strong operating capability aur financial depth ko dikhate hain. Is quarter mein almost har business vertical ne growth dikhayi hai.

📶 Jio Platforms – Digital Growth ka King

Jio, Reliance ka telecom aur digital arm, ab tak 200 million 5G users ko touch kar chuka hai. Iske alawa:

- ARPU (Average Revenue Per User): ₹208.8

- Net Profit: ₹7,110 crore (YoY growth ~25%)

Jio Fiber aur Fixed Wireless Access (FWA) bhi tezi se badh rahe hain. Jio ab duniya ke top FWA providers mein shamil ho gaya hai.

🛍️ Retail Segment – Har Ghar Reliance

Reliance Retail ne bhi shandar performance diya:

- Net Profit: ₹3,271 crore (YoY growth ~28%)

- Reliance Smart, Trends, aur Ajio jaise brands ne all-time high sales report ki.

- Grocery se lekar fashion aur electronics tak, sabhi segments ne contribute kiya.

Reliance Retail ka physical + digital model kaafi successful raha hai, aur har mahine naye stores khole ja rahe hain.

🛢️ Oil to Chemical (O2C) Business – Foundation of Growth

O2C business ab bhi Reliance ka sabse bada revenue contributor hai:

- Refining margins stable hain (~$10–11 per barrel)

- Petchem volume growth ne compensate kiya production shutdowns ko

- Oil price volatility ke bawajood, performance consistent raha

Ambani ka kehna hai ki O2C business ko gradually green energy mein transform kiya ja raha hai — Jamnagar plant uska living proof hai.

🌱 Green Energy & Future Plans

Reliance ka vision ab fossil fuel se hata kar green hydrogen, solar, aur renewable projects par focus kar raha hai. Mukesh Ambani ne announce kiya tha ki agle 10 saalon mein RIL ₹75,000 crore se zyada invest karega clean energy mein.

Jamnagar Green Energy Giga Complex jaisa project RIL ke future sustainability goals ko dikhata hai. Ye long-term mein company ke valuation ko aur strong karega.

📉 Share Price Levels & Target Projections

🔎 Current Price:

- ₹1476 (as of July 18, 2025)

📅 Year-to-Date Performance:

- +20–22%

📌 Short-Term Targets:

- ₹1550 – ₹1600 (based on analyst consensus)

📈 Long-Term Targets (2026 onwards):

- ₹2000+ possible if growth trend continues

Technical charts dikhate hain ki stock strong support zone se bounce kar raha hai aur next resistance ₹1580 ke aaspaas aa sakta hai.

🔐 Key Strengths – Reliance Ko Unique Banane Wale Factors

- Diversified Business Model – Telecom, Retail, Energy, Digital Services – har sector mein presence.

- Strong Management – Mukesh Ambani ke visionary leadership ne company ko global level par le ja diya.

- Consistent Earnings Growth – Har saal stable profits aur increasing margins.

- Future-Ready Investments – 5G, AI, cloud, aur green energy mein aggressive investments.

⚠️ Risk Factors – Kya Sambhalna Zaroori Hai?

- Oil Prices: Agar global oil prices crash hote hain, O2C business pe impact pad sakta hai.

- Regulatory Pressure: Telecom aur Retail sectors mein strict regulation challenges la sakta hai.

- High CAPEX: Green energy projects mein heavy investments return lane mein time le sakte hain.

- Market Volatility: Macro-economic factors jaise interest rates, dollar strength ka asar stock par padta hai.

🧠 Kya Aapko Reliance Ke Shares Khareedne Chahiye?

Haan, lekin long-term view ke saath. Reliance ek stable aur diversified business house hai jo har naye sector mein first mover advantage leta hai. Agar aapka investment horizon 2–3 saal ya usse zyada ka hai, toh Reliance ek strong candidate hai portfolio ke liye.

📚 Summary – Ek Nazar Mein

| Parameter | Details |

|---|---|

| Current Price | ₹1476 |

| Market Cap | ~₹20 lakh crore |

| Q1 FY26 Net Profit | ₹26,994 crore (+78% YoY) |

| EBITDA Margin | 21.2% |

| ARPU (Jio) | ₹208.8 |

| Retail Net Profit | ₹3,271 crore |

| Short-Term Target | ₹1580 |

| Long-Term Potential | ₹2000+ |

| Risk Level | Moderate |

📢 Final Thoughts

Reliance ek aisi company hai jo har baar naye surprise ke saath aati hai — kabhi Jio launch, kabhi Retail expansion, kabhi green energy revolution. Agar aap ek future-ready, growth-oriented, aur India ke economic vision ka part banne wali company mein invest karna chahte hain — toh Reliance Industries aapke liye perfect bet ho sakta hai.

Aap kya sochte hain? Kya Reliance ₹2000 tak pahuch paayega 2026 tak? Apna opinion comment mein zarur share karein!